SIP Calculator with Inflation, Expense Ratio and Exit Load ✦ Try Now!

Total Investment: ₹1,20,000

Total Return: ₹1,55,217

Final Value: ₹2,75,217

Exit Load Charge: ₹0

Short Term Capital Gains Tax: ₹0

Long Term Capital Gains Tax: ₹5,743

Expense Ratio Charge: ₹1,552

Net Profit (After Deductions): ₹1,47,922

Net Profit Adjusted for Inflation: ₹90,811

Final Inflation-Adjusted Value (If 0 Deductions): ₹1,68,959

What is the SIP Calculator with Inflation?

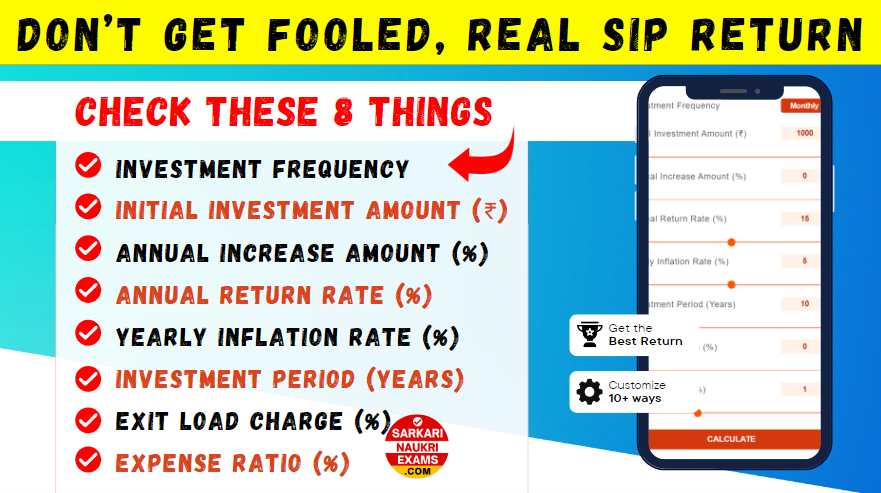

The SIP calculator with inflation is a tool that calculates the actual return on investments after a certain period. This calculator takes into account various deductions such as taxes, exit load, and expense ratios to give you an accurate assessment of the actual profit. By using this SIP Mutual Fund Calculator, you can invest your money with the necessary information and avoid any potential regrets about hidden charges in the future.

What is Expense Ratio Charge and Exit Load in SIP Calculator with Inflation?

The expense ratio and exit load are important factors to consider while investing in mutual funds. The expense ratio is the annual fee charged by the fund to cover operational expenses, while exit load is a fee charged if you sell or redeem your investments before a specific period. Exit load charges are usually between 1% to 2%. Both can impact your investment returns, so be sure to check the fund's rules for details.

SIP Calculator with Inflation Adjustment and Taxes

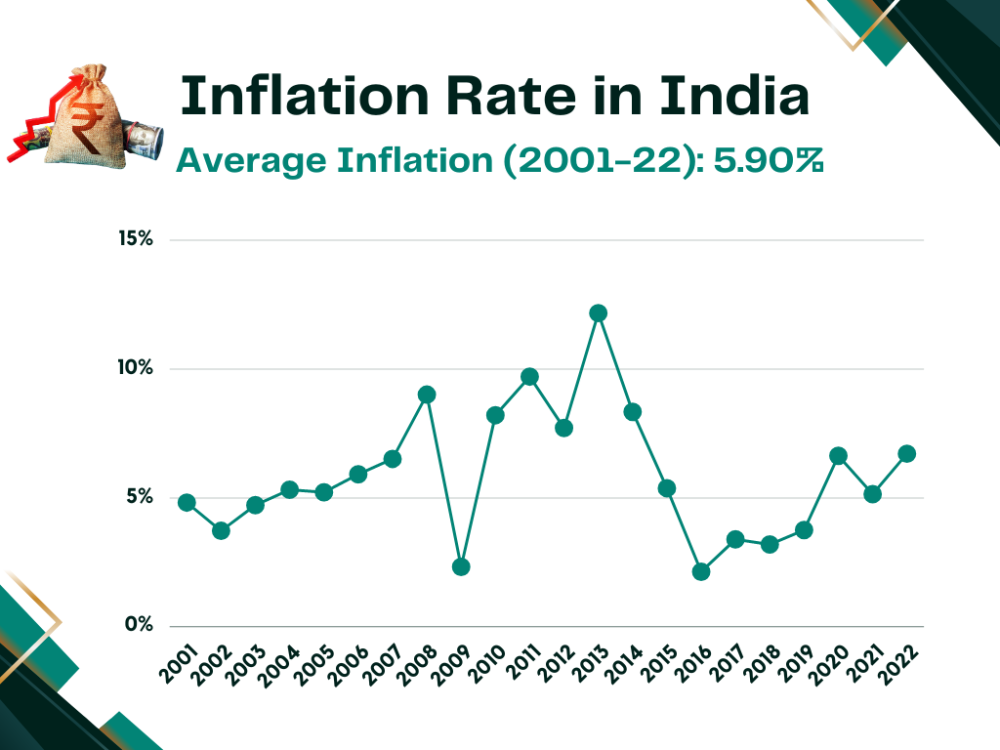

The "SIP Calculator" calculates the returns on investment by considering factors in the impact of inflation and taxes. This tool helps individuals to get a better understanding of how their investments will perform in the long run and to make informed decisions about their financial planning. Here are the average, highest and lowest inflation rates in India:

✭ The average Inflation rate in India is 5.90% since (2001-2022).

✭ The highest inflation rate was 34.7% in October 1974.

✭ The lowest inflation rate was -11.3% in May 1976

Know Terms related to the SIP Calculator with Inflation Adjustment

Before investing, check important SIP terms and conditions. Here are the some terms are mentioned for better clearity.

✭ Know these Investment Terms:

- Initial Investment: Starting amount.

- Yearly Increment: Annual increase to counteract inflation.

- Number of Years: Investment duration.

- Expected Annual Return: Average yearly growth rate.

- Inflation Rate: Annual increase in the general price level.

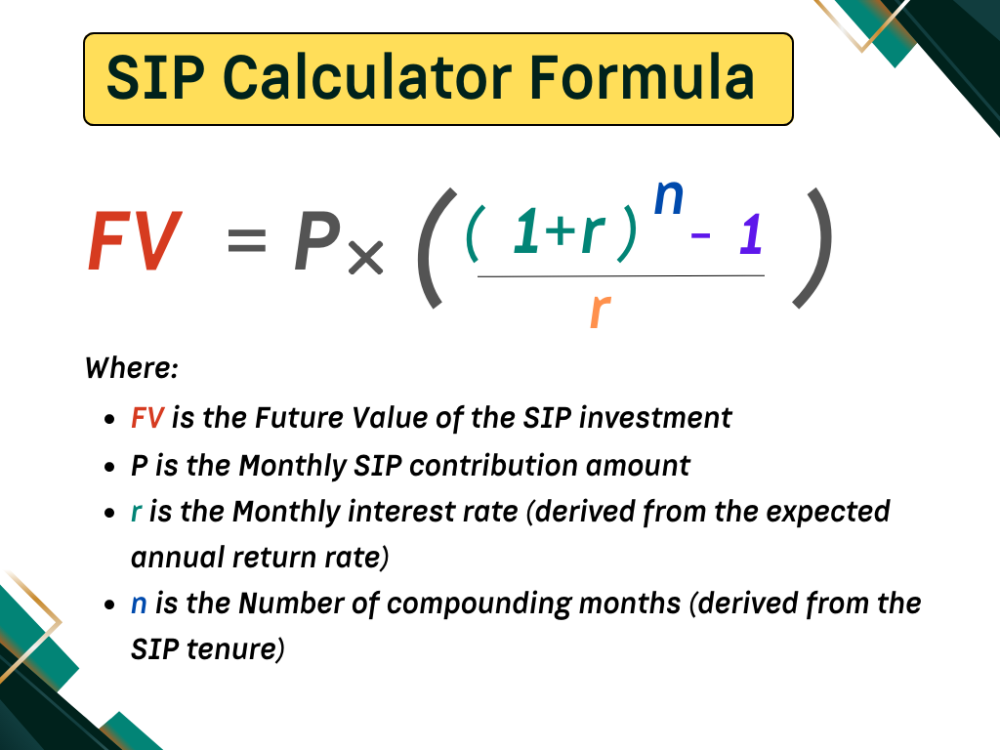

SIP Calculator Formula

SIP Calculator Formula:

Future Value (FV) = P * [(1 + r)^n - 1] / r

Where:

- = Future Value of the SIP investment

- = Monthly SIP contribution amount

- = Monthly interest rate (derived from the expected annual return rate)

- = Number of compounding periods (derived from the SIP tenure in months)

The calculator calculates the estimated investment value at the end of the chosen SIP tenure. However, the actual returns may vary due to market changes and other factors. The calculator provides an approximation and not a guaranteed outcome.

Comments-

Sarkari Naukri Exams-

Thanks for visiting us!

If you have any question please add a comment.

We will reply within 24 Hours.

Thanks & Regards!

Sarkari Naukri Exams.

Updated:

Highlights

Advertisements

Comment