Rajasthan RO Salary 2025 - RPSC Grade Pay, Monthly Pay & In-Hand

.jpg)

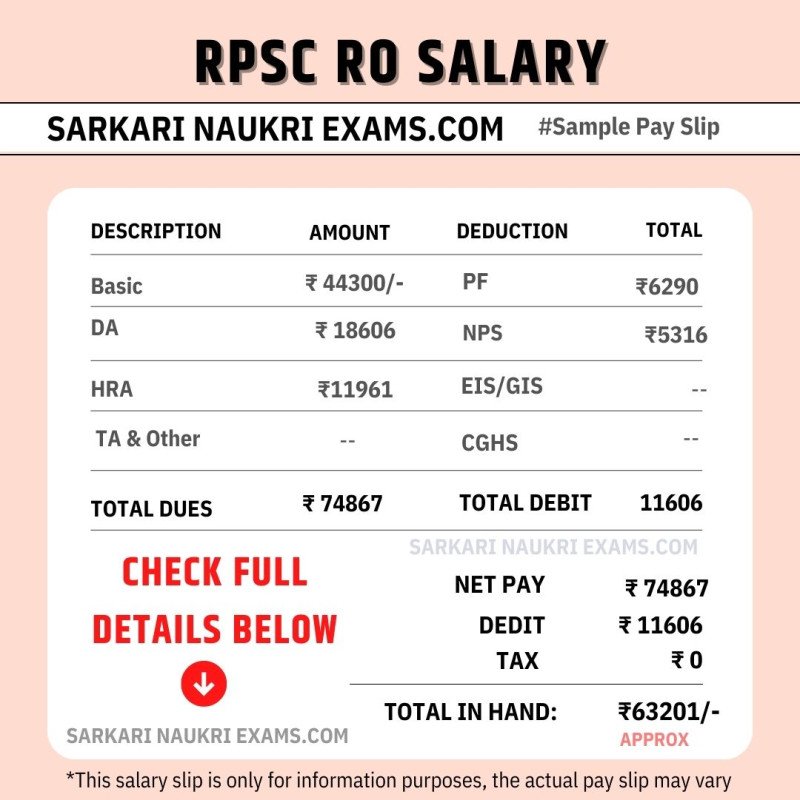

The salary scale of the 2025 Rajasthan Revenue Officer under the 7th Pay Commission has been devised to be in the pay scale range of Rs. 44,300 to Rs. 1,40,100. In addition to a basic pay of Rs. 44,300, the basic pay, Revenue Officers get allowances, including Dearness Allowance (DA), House Rent Allowance (HRA), and Transport Allowance (TA), etc. The approximate in-hand salary a Revenue Officer would receive at the starting point is Rs. 63,201 a month, and the in-hand salary increases with promotions and increments. Other deductions are also applicable, such as Provident Fund (PF) and National Pension Scheme (NPS), which are added up to give the final net salary.

RPSC Revenue Officer(RO) Salary 7th Pay Commission

| CATEGORY | AMOUNT |

|---|---|

| Pay Level | 12 |

| Pay Band | PB-3(9300-34800) |

| Grade Pay | 4800 |

| Pay Scale | Rs.44300/- to 140100/- |

| Basic Salary | Rs. 44300/-/- |

| Maximum Salary | Rs. 140100/- |

| Dearness Allowance (DA) | 53% Of Basic Pay |

| House Rent Allowance (HRA) | 30% Of Basic Pay |

| Transport Allowance (TA) | As Per Applicable |

| Other Work Allowance | As Per Applicable |

| PF | Rs. 6290/- |

| NPS | Rs. 5316/- |

| Tax | NA |

| In Hand Payment | Rs. 68900/- |

| ✦ Check More Details (⬇) | |

RPSC Revenue Officer(RO) Salary In Hand Per Month

The salary of a Rajasthan Revenue Officer (RO) is determined by basic salary, allowances and different cuts.

Total Salary = Basic Salary + All Allowances (DA, TA, HRA) - All Deduction (Rajasthan, NPS, PF)

Starting In Hand Salary = 44300/- (Basic Pay) + (DA) + (HRA) - 6290 (PF) - 5316 (NPS)

Starting In Hand Salary = Rs 68900 (Approx) Monthly

Rajasthan RO Allowances and Perks

✦ Top Rajasthan Revenue Officer(RO) Govt Jobs Perks

01 DA

02 HRA

03 TA

04 Daily Extra duty

05 Insurance Cover

06 Food Allowance

07 Special Duty Allowance (SDA)

08 NPS

Rajasthan RO Salary 2025 Deductions Details

To ensure the bright future of our frontline govt workers, the state govt deducts some amount from their salary. These deductions are 10% Basic for NPS, 12% of Basic for PF, and Rs. 100 per month as Insurance Cover.

| DEDUCTIONS | AMOUNT |

|---|---|

| NPS | Rs.6290/- (10% Of Basic Pay+DA) |

| PF | Rs.5316/- (12% Of Basic Pay) |

| Rajasthan | Applicable (If income will be above 5 lac) |

| Insurance Cover | Rs. 100/- |

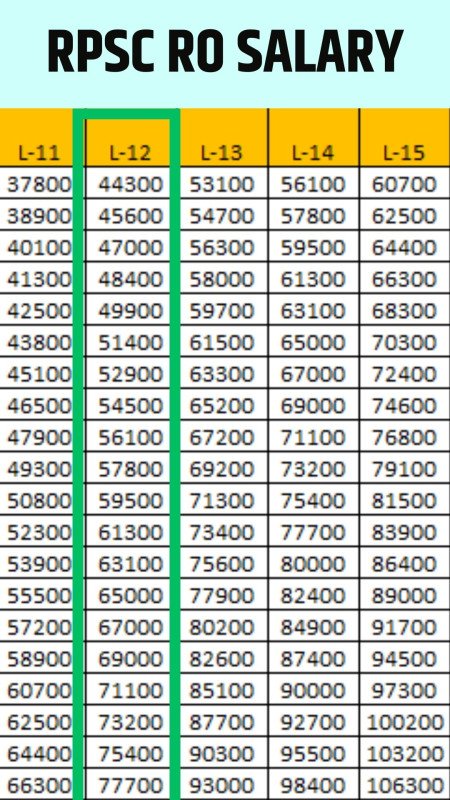

Rajasthan RO Salary After 7th pay commission

Rajasthan RO board recruitment is done under the state govt supervision. Therefore Rajasthan Revenue Officer salary comes under the 7th pay matrix of Rajasthan govt norms. Here are the details of the 7th pay salary matrix.

.jpg)

RPSC RO Salary 2025FAQs

⭐What is the pay level for Rajasthan Revenue Officers (RO)?Rajasthan Revenue Officers fall under Pay Level 12.

⭐What is the grade pay for Rajasthan Revenue Officers?The grade pay is 4800.

⭐What is the pay scale for a Rajasthan RO Officer?The pay scale ranges from Rs. 44,300/- to Rs. 1,40,100/-.

⭐What is the maximum salary for Rajasthan Revenue Officers?The maximum salary can be earn is Rs. 1,40,100/-.

Comments-

Sarkari Naukri Exams-

Thanks for visiting us!

If you have any question please add a comment.

We will reply within 24 Hours.

Thanks & Regards!

Sarkari Naukri Exams.

Updated:

Highlights

Advertisements

Comment