DSSSB Welfare Officer (WO) Salary 2025 | Monthly Payment, In Hand Amount

DSSSB Welfare Officer (WO) Salary

DSSSB Job ( Full Time )

Level

6

Grade Pay

4200

Basic Salary

Rs 35400/-

Maximum Salary

Rs 112400/-

Min (In Hand)

≈ ₹ 51614/-Month

Max (In Hand)

≈ ₹128614/-Month

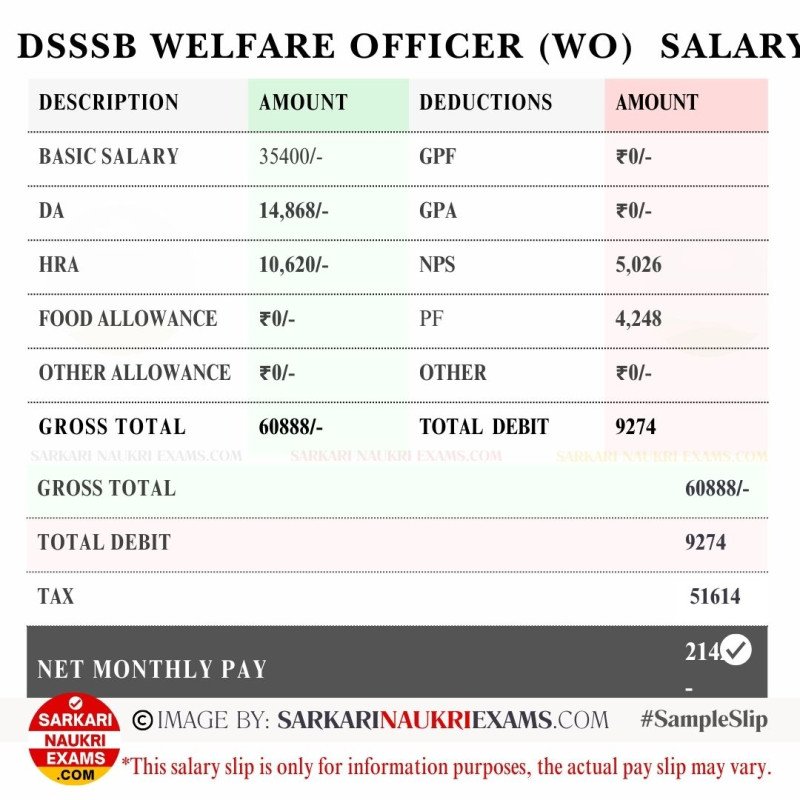

The DSSSB Welfare Officer (WO) earns a monthly salary, and here's the breakdown. The job is full-time, and it's at Level 6. The Grade Pay is 4200, adding up to a complete pay structure. The salary range is from Rs 9300/- to 34,800/-. The core of the pay is the Basic Salary, which is Rs 35,400/-. The salary can go up to a maximum of Rs 1,12,400/-, showing room for career growth. There are extra parts of the salary, like Dearness Allowance (DA) at 53% of Basic Pay and House Rent Allowance (HRA) at Rs 10,620/- (30% of Basic Pay). Transport Allowance (TA) follows the rules. The minimum take-home salary for the DSSSB Welfare Officer is around ₹51614/- per month, giving a clear picture of the overall compensation. On the higher side, the maximum in-hand salary is approximately ₹1,28,614/- per month.

★ Top 3 key highlights:

-

DSSSB Welfare Officer (WO) Salary 2024: Rs 35400/- to Rs 112400/- per month

-

DSSSB Welfare Officer (WO) Initial Pay: Rs 51614/- per month

-

DSSSB Welfare Officer (WO) Maximum Salary: Rs 128614/- per month

- DSSSB Welfare Officer (WO) Salary 2025

- DSSSB Welfare Officer Salary Allowances (2025)

- DSSSB Welfare Officer Salary Deductions (2025)

- House Rent Allowance (HRA)

- Dearness Allowance (DA)

- Transport Allowance (TA)

- Medical Allowance

- Meal Allowance

- Uniform Allowance

- Washing Allowance

- Education Allowance

- Leave Travel Concession (LTC)

- Rest Room Allowance

- Cycle Allowance

- Night Shift Allowance

- Overtime Allowance

- Field Allowance

- Special Duty Allowance

- Risk Allowance

- Provident Fund (PF)

- New Pension Scheme (NPS)

- Health Insurance

- Group Insurance

- Professional Tax

- DSSSB Welfare Officer (WO) Salary Calculation

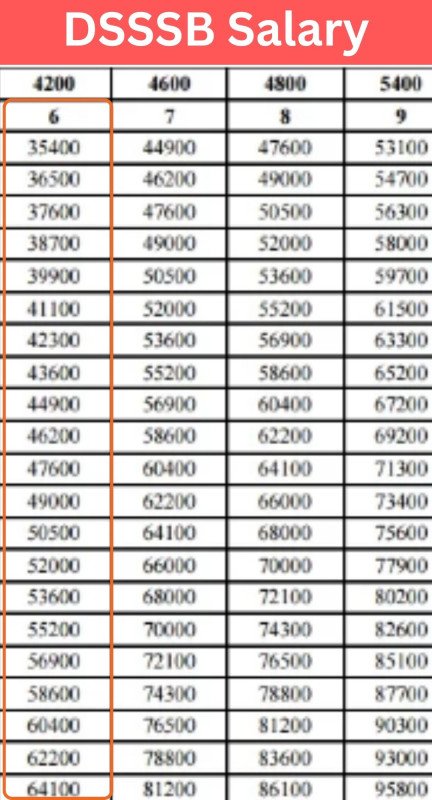

- DSSSB Welfare Officer (WO) Salary 7th Pay Commission

DSSSB Welfare Officer (WO) Salary 2025

| Information | Details |

|---|---|

| Name | DSSSB Welfare Officer (WO) Salary |

| Profession | DSSSB Job ( Full Time ) |

| Level | 6 |

| Grade Pay | 4200 |

| Pay Band | Rs 9300/- to 34,800/- |

| Basic Salary | Rs 35400/- |

| Maximum Salary | Rs 112400/- |

| (DA) | Rs 14,868/- (42% Of Basic Pay) |

| (HRA) | Rs 10,620/-(30% Of Basic Pay) |

| Transport Allowance (TA) | As Per Applicable |

| Min (In Hand) | ≈ ₹ 51614/-Month |

| Max (In Hand) | ≈ ₹128614/-Month |

DSSSB Welfare Officer Salary Allowances (2025)

The 2024 recruitment process for the Welfare Officer (WO) position at DSSSB will involve thorough assessments, including written exams and typing evaluations. Successful candidates can anticipate a competitive salary package in adherence to government guidelines. This comprehensive package encompasses components like House Rent Allowance (H.R.A.), Arrears, Travel Allowance (T.A.), and Dearness Allowance (D.A.).

House Rent Allowance (HRA)

30% of Basic Pay

Dearness Allowance (DA)

42% of Basic Pay

Transport Allowance (TA)

8% of Basic Pay

Medical Allowance

17% of Basic Pay

Meal Allowance

900/- per month

Uniform Allowance

2000/- per annum

Washing Allowance

360/- per annum

Education Allowance

200/- per child per month (maximum of two children)

Leave Travel Concession (LTC)

One return journey in Air-Conditioned Rail for self, spouse and two children every two years

Rest Room Allowance

150/- per month

Cycle Allowance

200/- per month

Night Shift Allowance

20% of Basic Pay for night duties performed between 2200 hrs and 0600 hrs

Overtime Allowance

200% of Basic Pay for overtime duties performed beyond 0800 hrs on working days and beyond 1400 hrs on Sundays and holidays

Field Allowance

200/- per month

Special Duty Allowance

20% of Basic Pay for duties performed in areas declared as "disturbed" or "sensitive"

Risk Allowance

20% of Basic Pay for duties performed in areas prone to natural calamities or riots

DSSSB Welfare Officer Salary Deductions (2025)

In the salary framework for the DSSSB Welfare Officer (WO), deductions are implemented on both basic salaries and allowances. The following table provides a concise overview of commonly used deduction categories.

Provident Fund (PF)

12% of Basic Salary

New Pension Scheme (NPS)

10% of Basic Salary (Government Contribution)

Health Insurance

Rs.480 per month (Individual) or Rs.960 per month (Family)

Group Insurance

Rs.400 per month (Individual) or Rs.800 per month (Family)

Professional Tax

2% of Basic Salary (Upto Rs.10,000) 3% of Basic Salary (Rs.10,000 - Rs.20,000) 4% of Basic Salary (Above Rs.20,000)

DSSSB Welfare Officer (WO) Salary Calculation

To calculate the Total In-Hand Salary for DSSSB Welfare Officer (WO) Salary

➜ Step 1: Calculate the DA Amount

DA Amount = Current DA Rate * Basic Salary (Starting)

DA Amount = 42% * 35400/- = Rs 14,868/-

➜ Step 2: Calculate the HRA Amount

HRA Amount = Current HRA Rate * Basic Salary (Starting)

HRA Amount = 30% * 35400/- = Rs 10,620/-

➜ Step 3: Calculate the PF Amount

PF Amount = PF (Employee's contribution) * Basic Salary (Starting)

PF Amount = 12% *35400/- = Rs 4,248/-

➜ Step 4: Calculate the NPS Amount

NPS Amount = NPS (Employee's contribution) * (Basic Salary (Starting) + DA Amount)

NPS Amount = 10% * (35400 +14,868/-) = 50,268/-

➜ Step 5: Calculate the Total In-Hand Salary

Total In-Hand Salary = Basic Salary (Starting) + DA Amount + HRA Amount - PF Amount - NPS Amount

Total In-Hand Salary = 35,400+14,868+10,620−4,248−5,026 = Rs 51614/-

➜ Conclusion:

The Total In-Hand Salary for a DSSSB Welfare Officer (WO) Salary is Rs = 51614/-

DSSSB Welfare Officer (WO) Salary 7th Pay Commission

✦ Top DSSSB Welfare Officer (WO) Salary Govt Jobs Perks

01 DA

02 HRA

03 TA

04 NPS

05 MA

.jpg)

DSSSB Welfare Officer (WO) Salary 2025 FAQs

⭐What is the pay level for the DSSSB Welfare Officer (WO)?DSSSB Welfare Officer is placed at Level 6.

⭐What is the basic salary for a DSSSB Welfare Officer salary 2024?The basic salary is Rs 35,400/-.

⭐How is the maximum salary calculated for DSSSB WO's expected salary in 2024?The maximum salary is Rs 1,12,400/-, including allowances such as DA and HRA.

⭐What is the approximate minimum in-hand salary for a DSSSB Welfare Officer?The minimum in-hand salary is around ₹1,28,614/- per month.

Comments-

Sarkari Naukri Exams-

Thanks for visiting us!

If you have any question please add a comment.

We will reply within 24 Hours.

Thanks & Regards!

Sarkari Naukri Exams.

Updated:

Highlights

Advertisements

Comment